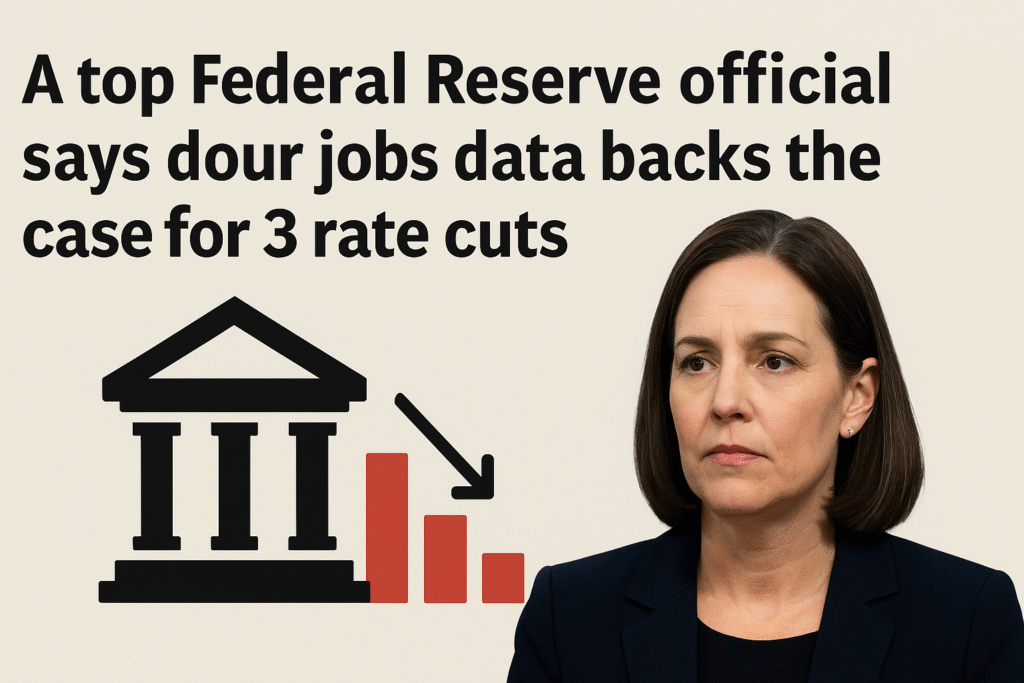

Federal Reserve Governor Michelle Bowman has indicated that the recent disappointing U.S. jobs report has reinforced her belief that interest rates should be reduced three times this year.

Speaking at a bankers’ conference in Colorado on Saturday, Bowman pointed to the latest labor market figures—showing far fewer new hires than expected and downward revisions to previous months—as evidence that the economy could benefit from lower borrowing costs.

Bowman was one of only two Fed members who recently voted in favor of a rate cut, while the majority opted to keep rates unchanged. Fed Chair Jerome Powell has maintained a cautious stance, emphasizing the need to monitor how President Donald Trump’s tariffs might influence inflation before making policy changes.

Bowman expressed growing confidence that the tariffs will not cause sustained inflationary pressure, noting that price growth is moving closer to the Fed’s 2% target. Although inflation has eased significantly from its post-pandemic peak of over 9%, it remains above that benchmark.

The Federal Reserve faces the ongoing challenge of balancing its dual mandate—supporting job growth while keeping inflation under control—using interest rate adjustments as its primary tool. Some economists warn that the combination of slowing economic growth and persistent inflation, known as “stagflation,” could leave the Fed with difficult policy choices.

Market analysts now widely expect the Fed to implement a rate cut at its September meeting, following the weaker-than-forecast jobs data. Meanwhile, President Trump has continued to publicly push for lower rates and could soon appoint a new member to the Fed’s Board of Governors after a recent vacancy.